I have always been an avid saver since my elementary days, and I think that is one of the traits I am proud of. I don’t necessarily buy stuff impulsively or any luxury items for the matter unless they are bang for the buck and of great value, might not be the latest gadget but has an overall good specs at hand. I admit that after graduating college and working in Manila, I started buying clothes that accumulated over time in the province and Manila which I am now thinking ways to dispose, resell, or donate. Later, around 2017, I have decided not to buy clothes or things unless they are a need and not a want. I have been travelling for quite a few years by that time, but I realized that I want to spend more on my passion and experience more than things especially those that rust out because you wouldn’t be able to use them anytime soon.

But saving and minimalism could only do so much, another thing I am proud of is having started to invest at an early age, few years when I started working in Manila. I am grateful to have met the right people with the same interests such as photographers, bloggers, influencers, and most especially investors who imparted so much to my financial well-being. See, I usually play it safe or take calculated risks. But when you get to know different perspectives, you realize you have the potential to do more than what you were once told or used to. Endless doors of possibilities started to open.

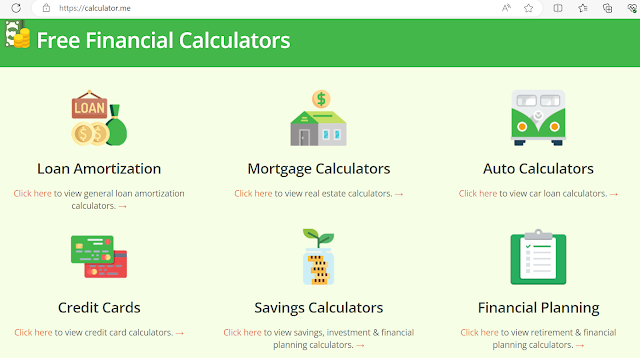

What I like about calculator.me is that they offer these kinds of features that I have learned through the years by chance, you can manage to do so with their offerings in terms of different financial calculators in loans, savings, credit, retirement, budgeting, education, mortgages, among others – all necessary to have a sound financial health in line with your goals.

Savings/Budgeting – very essential building block to one’s life which you can divide to afford your cost of living, have just pure savings, emergency fund, and maybe even start some value investments.

Credit – my rule ever since is to use it as cash meaning if I have the cash to buy this, I use my credit card or line because I could earn points and maximize my account.

Loan/Mortgage/Auto – for amounts too large for you to cover for now, this is an exception. Say for your home or a car but you must ensure that your monthly income minus the cost of living, savings, investments, etc would NOT be sacrificed when doing such big decision. Otherwise, you must retrace or rethink your approach. A little sacrifice for the goal of long-term comfort.

Financial Planning/Retirement – another essential especially to those who have been a workforce all their life. We need to wisely invest for our sunset years and ensure we didn’t work so hard for nothing.

Klook.com

0 comments:

Post a Comment

Feel free to share your thoughts! I will be very happy to know you've dropped by. :)